AI in Healthcare Claims Processing: A Practical Implementation & ROI Guide

By Darshak Doshi

February 19, 2026

Summary:

Healthcare claims processing is often slow, manual, and prone to costly errors. This blog breaks down how AI in healthcare helps reduce denials, speed up reimbursements, and improve revenue cycle performance. You’ll see how AI supports each step of the claims process, what benefits providers and insurers can expect, and what it takes to implement it properly. It also covers ROI, costs, compliance, and common challenges in simple, practical terms.

The Growing Impact of AI in Healthcare Operations

Walk into any hospital billing office, and you’ll feel it. The quiet tension. The stacks of files. The “we’re still waiting on that claim” conversations. Healthcare runs on care. But it survives on reimbursement. And that’s where things often get messy.

AI in healthcare is starting to change how operations work behind the scenes. Not in a flashy, sci-fi way. More in a practical, roll-up-your-sleeves kind of way. It helps teams catch errors early, process claims faster, and avoid those painful denials that stall revenue.

How AI in healthcare is changing operational efficiency

Operational efficiency used to mean hiring more staff to handle more claims. More volume? Add more people. But that model doesn’t scale well. It’s expensive. It’s exhausting. And honestly, it’s error-prone.

AI changes that dynamic. It reviews documentation in seconds. It flags mismatches between diagnosis and procedure codes. It learns from past denials and spots patterns humans might miss on a long Tuesday afternoon. Instead of reacting to problems, teams can prevent them. That shift alone changes everything.

Challenges in Traditional Claims Processing

Let’s be honest. Traditional claims processing is fragile. It depends heavily on manual work, fragmented systems, and a lot of patience.

Manual coding and documentation errors

Coding errors happen. A digit off. A missing modifier. A mismatched diagnosis. Most of the time, it’s not negligence. It’s an overload. Coders review hundreds of records daily. Fatigue creeps in. And small mistakes turn into denied claims.

High denial and rejection rates

Denials don’t just hurt revenue. They drain morale. When denial rates rise, teams spend hours reworking submissions instead of focusing on new claims. It becomes a cycle. Fix, resubmit, wait. Repeat.

Delayed reimbursements and cash flow gaps

A delayed claim means delayed payment. That delay can stretch from weeks to months. For healthcare providers, this affects payroll, equipment purchases, and expansion plans. Cash flow gaps aren’t abstract. They’re real.

Compliance and audit risks

Healthcare is tightly regulated. Every claim must follow strict rules. Manual processes increase the risk of missing documentation, incomplete records, or coding mismatches. Audits become stressful events instead of routine checks.

Rising administrative costs

More denials mean more rework. More rework means more staff time. Administrative overhead keeps rising. And it often feels like there’s no clear way to stop the climb.

How AI in Healthcare Improves Claims Management

AI doesn’t just automate steps. It changes how decisions are made.

Moving beyond rule-based automation

Basic automation follows fixed rules. If X happens, do Y. AI goes further. It analyzes patterns. It learns from outcomes. It adapts. Instead of simply checking if a field is filled, it evaluates whether the documentation actually supports the claim.

Supporting faster and more accurate decisions

AI systems can review thousands of data points in seconds. That includes patient history, prior claims, payer policies, and coding guidelines. This reduces guesswork. Decisions become data-backed instead of instinct-driven.

Strengthening revenue cycle performance

When errors are caught before submission, denial rates drop. When claims move faster, reimbursement improves.

When patterns are identified early, process improvements follow. Revenue cycle performance becomes more predictable. And predictability is gold in healthcare finance.

Automated data extraction from medical records

AI for healthcare tools can automatically extract structured data from clinical notes, discharge summaries, and lab reports. This reduces manual entry, minimizes errors, and ensures critical details aren’t missed.

Intelligent coding validation

Before a claim goes out, AI checks whether diagnosis codes match procedures and whether documentation supports the billing. It acts like a second pair of eyes. A very fast one.

Predictive denial detection

AI can flag claims that are likely to be denied based on historical payer behavior. Instead of waiting for rejection, teams fix the issue before submission. That’s a big shift.

Fraud detection and risk analysis

AI can identify unusual billing patterns or inconsistencies across large datasets. This helps reduce fraud risk and supports internal compliance efforts.

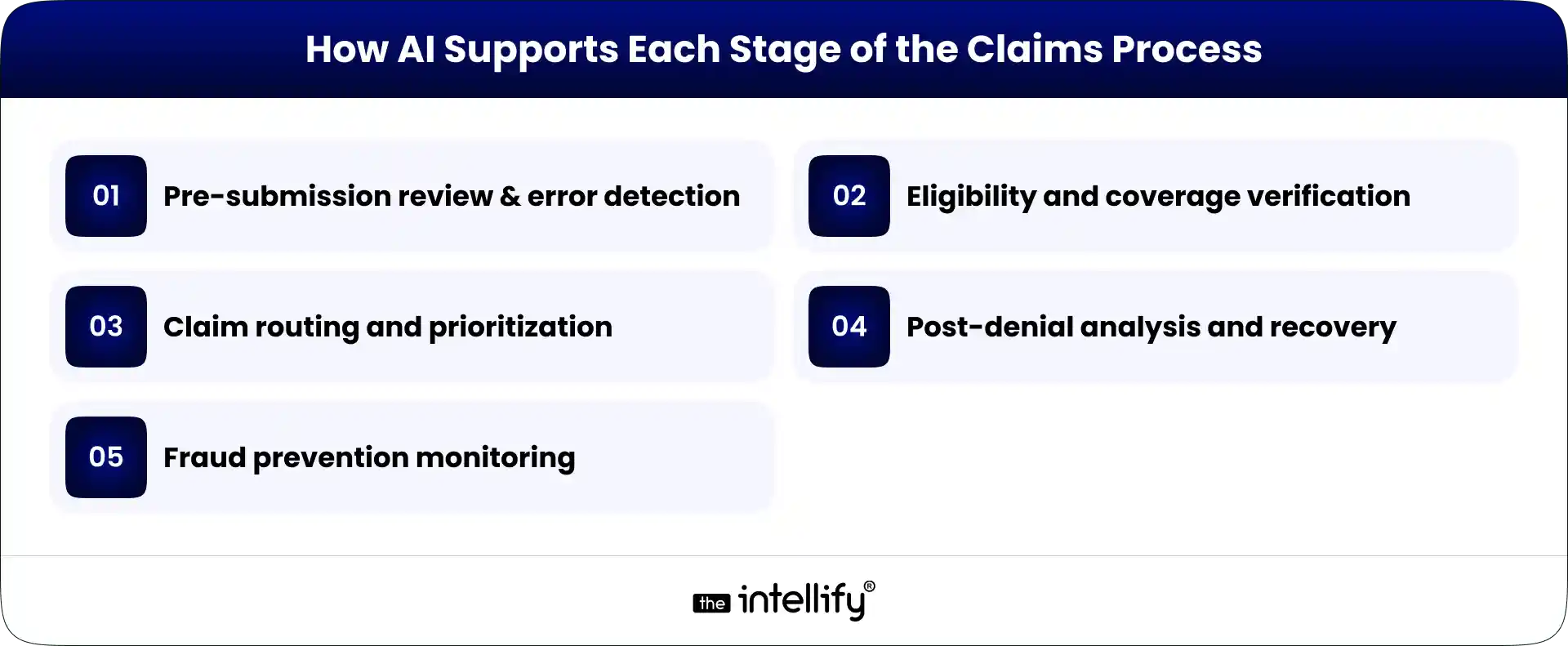

How AI Supports Each Stage of the Claims Process

Let’s break it down in simple terms.

Pre-submission review and error detection

Before sending a claim, AI checks for missing fields, mismatches, and incomplete documentation. It’s like proofreading an email before hitting send. Basic, but powerful.

Eligibility and coverage verification

AI verifies patient coverage in real time. It checks whether services are covered under specific plans. Fewer surprises later.

Claim routing and prioritization

Some claims need faster attention. AI can prioritize high-value or high-risk claims automatically. This keeps critical cases moving.

Post-denial analysis and recovery

When a denial does happen, AI analyzes the reason and suggests corrective action. Instead of manually digging through records, teams get guided insights.

Fraud prevention monitoring

AI continuously monitors claim patterns. If something unusual appears, it flags it. Not dramatic. Just steady oversight.

Key Benefits for Healthcare Providers and Insurance Teams

Here’s what this actually means on the ground.

Faster claims processing cycles

- Claims move from submission to reimbursement more quickly.

- Less waiting. Less uncertainty.

Lower denial and appeal rates

- When errors are caught early, denial rates drop.

- Appeals become the exception, not the norm.

Reduced administrative workload

- Teams spend less time correcting mistakes.

- That time can go toward patient communication or financial planning instead.

Improved cash flow stability

- Faster reimbursements create steadier revenue streams.

- And steadier revenue reduces financial stress.

Stronger compliance readiness

- With consistent validation and monitoring, audit risks decrease.

- Documentation is more complete. Records are easier to retrieve.

Implementing AI in Healthcare: A Step-by-Step Approach

This isn’t a switch you flip overnight.

Assessing existing revenue cycle workflows

Start by mapping your current process. Where do errors happen most? Where are delays common? Be honest. Even if it’s uncomfortable.

Identifying high-impact automation areas

Focus first on steps with high denial rates or heavy manual effort. Small wins build confidence.

Selecting the right solution partner

Look for a partner who understands healthcare regulations and billing realities. Not just someone selling software.

Integration with EHR and billing systems

AI in Healthcare must integrate seamlessly with existing EHR and billing systems. Poor integration can disrupt workflows instead of improving efficiency.

Pilot deployment and staff training

Start small. Run a pilot. Train teams clearly. Change feels scary at first. That’s normal.

Monitoring performance and scaling

Track metrics. Compare denial rates before and after. If results are strong, expand gradually.

Understanding ROI in AI-Driven Claims Processing

ROI isn’t just about cost savings. It’s about control.

Reduction in denial rates

Even a small percentage drop in denials can translate into significant revenue protection.

Faster reimbursement timelines

Shorter payment cycles improve working capital.

Administrative cost savings

Less rework means fewer overtime hours and lower staffing pressure.

Revenue recovery improvements

AI can identify underpayments and missed billing opportunities.

Money that might have slipped through the cracks comes back.

Key performance indicators to track

- Denial rate percentage

- Days in accounts receivable

- Cost per claim processed

- First-pass claim acceptance rate

- Appeal success rate

These numbers tell the real story.

Cost and Investment Considerations

AI requires investment. There’s no sugarcoating that.

Technology and licensing costs

Software subscriptions or platform licenses form the base cost.

Integration and infrastructure needs

Some upgrades to infrastructure or system connectors may be needed.

Training and change management

Teams need training. And time to adjust.

Ongoing maintenance and compliance

Systems require updates. Regulations change. Monitoring is continuous.

Challenges in Adopting AI for Healthcare Claims

It’s not all smooth sailing.

Data quality and standardization issues

If data is inconsistent or incomplete, AI struggles. Clean data matters more than fancy algorithms.

Integration with legacy systems

Older systems may resist integration. Sometimes the tech feels like it’s from 2009. And it probably is.

Workforce adaptation and change resistance

Some staff may worry about job security. Clear communication is essential. AI supports teams; it doesn’t replace them.

Data security and regulatory risks

Healthcare data is sensitive. Strong encryption, access controls, and compliance practices are non-negotiable.

Governance, Compliance, and Responsible Use

AI must be used carefully.

Data privacy requirements

Patient data must remain protected under regulatory standards. No shortcuts here.

Transparency in automated decisions

If a claim is flagged or rejected, there should be a clear explanation. Black-box decisions create trust issues.

Audit trails and accountability

Systems should log actions and changes. This supports audits and internal reviews.

Risk management practices

Regular system evaluations and compliance checks help reduce long-term risk.

The Future of AI in Healthcare Claims Management

The direction is clear:

Real-time claims adjudication

AI could enable near-instant claim review and approval. Imagine submitting and receiving confirmation within minutes. Not weeks.

Predictive revenue forecasting

Using historical data, AI can project revenue trends and identify risk periods ahead of time.

End-to-end revenue automation

From patient registration to final reimbursement, automation may streamline the full revenue cycle.

Expanding AI across healthcare operations

Claims are just one piece. Scheduling, patient communication, supply chain management AI is expanding across operations.

Conclusion

AI in healthcare is not about replacing people. It’s about reducing friction. It helps teams avoid preventable errors. It stabilizes cash flow. It reduces administrative pressure. But success depends on structured implementation. Clear goals. Clean data. Strong governance.

When done thoughtfully, AI transforms claims processing from a reactive process into a controlled, measurable system. And honestly? In a world where healthcare margins are tight and expectations are high, that kind of stability feels like a breath of fresh air.

Frequently Asked Questions (FAQs)

1. What does AI in healthcare claims management mean?

It means using intelligent software to review, validate, and process healthcare claims automatically. AI reads medical records, checks codes, and flags errors before submission. At The Intellify, we use AI to simplify claims workflows and reduce manual effort without disrupting existing systems.

2. How does AI help reduce claim denials?

AI reviews claims before they’re sent to payers. It detects missing details, coding mismatches, or policy conflicts early. By fixing issues upfront, providers avoid preventable denials and repeated rework.

3. Will AI replace human staff in claims processing?

No. AI handles repetitive checks and data validation. Human teams still manage decisions, exceptions, and compliance oversight. The goal is support not replacement.

4. Can AI detect fraudulent claims?

Yes. AI identifies unusual billing patterns and inconsistencies across large datasets. This helps flag potential fraud early and reduces financial risk.

5. What are the common challenges when adopting AI for claims?

Common issues include poor data quality, legacy system integration, and staff resistance to change. A structured rollout plan helps reduce these risks.

6. How does AI improve reimbursement speed?

By reducing errors and automating validation, AI increases first-pass acceptance rates. Fewer rejections mean faster approvals and quicker payments

Written By, Darshak Doshi

With over a decade of experience, Darshak is a technopreneur specializing in cloud-based applications and product development in healthcare, insurance, and manufacturing. He excels in AWS Cloud, backend development, and immersive technologies like AR/VR to drive innovation and efficiency. Darshak has also explored AI/ML in insurance and healthcare, pushing the boundaries of technology to solve complex problems. His user-focused, results-driven approach ensures he builds scalable cloud solutions, cutting-edge AR/VR experiences, and AI-driven insights that meet today’s demands while anticipating future needs.

AI in AR & VR: Redefining Intelligent Immersive Experiences

Summary: AI is making AR and VR smarter, turning static experiences into adaptive, personalized environments. From training and healthcare to retail and gaming, intelligent immersive systems are improving engagement, learning, and decision-making. This blog explores how AI is shaping the future of immersive technology across industries. In a world where technology is changing faster than […]

How AI Automation Is Transforming Internal Operations in HR, Finance & IT

Summary: This blog explains why AI automation is becoming essential for modern business operations. It covers how AI automation differs from traditional automation, where it fits across HR, finance, and IT, and the real operational costs of relying on manual processes. The article also explores industry use cases, measurable benefits, implementation steps, and future trends, […]

How AI Is Transforming Customer Service & Business Growth in 2026

Summary: Customer service in 2026 looks very different from what it did just a few years ago. Long hold times, repetitive emails, and scripted replies are slowly fading out. In their place, AI-driven chatbots, voice agents, and smart analytics are helping businesses respond faster, personalize conversations, and grow revenue. This article walks through real use […]

AI in AR & VR: Redefining Intelligent Immersive Experiences

Summary: AI is making AR and VR smarter, turning static experiences into adaptive, personalized environments. From training and healthcare to retail and gaming, intelligent immersive systems are improving engagement, learning, and decision-making. This blog explores how AI is shaping the future of immersive technology across industries. In a world where technology is changing faster than […]

How AI Automation Is Transforming Internal Operations in HR, Finance & IT

Summary: This blog explains why AI automation is becoming essential for modern business operations. It covers how AI automation differs from traditional automation, where it fits across HR, finance, and IT, and the real operational costs of relying on manual processes. The article also explores industry use cases, measurable benefits, implementation steps, and future trends, […]

How AI Is Transforming Customer Service & Business Growth in 2026

Summary: Customer service in 2026 looks very different from what it did just a few years ago. Long hold times, repetitive emails, and scripted replies are slowly fading out. In their place, AI-driven chatbots, voice agents, and smart analytics are helping businesses respond faster, personalize conversations, and grow revenue. This article walks through real use […]

0

+0

+0

+0

+Committed Delivery Leads To Client Satisfaction

Client Testimonials that keep our expert's spirits highly motivated to deliver extraordinary solutions.