How AI Agents in Finance Are Transforming the Middle East

By Shravan Rajpurohit

December 30, 2025

Summary:

This Blog will explain what AI agents in finance are, their utility in the Middle Eastern market, their applications in the real world, the benefits they can bring to businesses, and how financial institutions can effectively utilize these tools.

The Middle East’s finance industry is changing quickly, mostly because of new technologies and a booming digital economy. AI agents in finance are becoming important players in these new technologies. They are changing the way banks and other financial institutions interact with their customers and run their businesses. In this blog, we’ll talk about how AI agents are changing the finance world in the Middle East. We’ll talk about what they can do, how they can help, and what they might be able to do in the future.

Why Finance in the Middle East Is Rapidly Changing

There is a big change happening in the Middle East’s finance industry. There are a few main things that are making this change happen:

- Economic Diversification: Countries like the UAE and Saudi Arabia are working hard to expand their economies beyond oil. This has led to more people using technology.

- Regulatory Support: Government programs are making it easier for new ideas to grow, especially those that are friendly to fintech.

- Digital Customer: People today want banking experiences that are smooth and tailored to their needs, which forces banks to change.

Digital Banking & Fintech Adoption Across GCC

The Gulf Cooperation Council (GCC) is leading the way in the use of digital banking and fintech. We’re seeing a lot of tech-based solutions that are making things better for customers. As more schools and businesses buy these new technologies, the need for more advanced features is growing.

How AI Agents Fit Into This Transformation

AI agents are becoming more and more important as this digital transformation happens. These smart systems are not only making customer service better, but they are also making operations run more smoothly, which helps banks work more efficiently.

What Are AI Agents in Finance?

AI agents are intelligent software programs that help with financial tasks, interact with customers, and look at data. Unlike traditional systems, they learn from data and get better at what they do all the time.

How AI Agents Are Different from Chatbots

Chatbots give generic, pre-programmed answers, but AI agents use machine learning to give personalized responses and solve difficult problems. This makes the experience more like a person.

How AI Agents Are More Than Just Automation

AI agents do more than just automate tasks; they also look for patterns, make predictions about the future, and give you useful information. This turns everyday tasks into strategic advantages for banks and other financial institutions.

Examples of What AI Agents Can Do

- Customer Service Answer common questions in real time.

- Loan Processing: Speed up approvals and make verifications easier.

- Fraud Detection: Watch transactions to see if anything strange happens.

Why AI Agents Matter Especially for the Middle East

1. Multilingual Banking Needs (Arabic + Expats)

The Middle East has a lot of different cultures, which makes it necessary for services to be available in many languages. AI agents can speak Arabic and other languages, which makes banking easier for a wider range of customers.

2. Support for Islamic Banking Workflows

AI agents can help with Sharia-compliant transactions, making sure they follow Islamic finance rules and making things easier for customers.

3. Increasing Cross-Border Transactions

AI agents make things easier and faster for cross-border trade and travel by making financial transactions in different currencies and under different rules easier and faster.

4. Rise of Digital-First Customers

More and more customers want online solutions, so AI agents are stepping up to meet the needs of a tech-savvy population by offering support and solutions on demand that traditional banking methods can’t match.

5. Increasing Compliance and Reporting Needs

The rules and regulations in the Middle East are complicated. AI agents can help banks stay in line by automating reporting and analysis.

Top Use Cases of AI Agents in Finance

Customer Support and Banking Queries

AI agents can quickly answer common banking questions, such as balance inquiries, transaction histories, and loan requests. They often do this faster than human agents.

Faster Loan Processing for SMEs

AI agents that automate risk assessments help small and medium-sized businesses (SMEs) get loans faster.

Sharia-Compliant Banking Journeys

AI can help customers smoothly navigate the steps of Islamic banking, making sure they follow the rules and have a better overall experience.

Fraud Detection and AML Monitoring

AI agents use complex algorithms to find fraud in real time, making things safer for both banks and customers.

Treasury & Liquidity Management

AI agents help banks manage their liquidity better by showing them how cash flow patterns work. This makes sure that banks always have the money they need.

Internal Finance Operations

AI agents can make things easier and more accurate for internal operations, from budgeting to forecasting.

Personalized Banking Recommendations

AI looks at how customers act to give them personalized financial advice and product suggestions, which makes them happier and keeps them as customers.

How AI Agents Support Key Financial Teams

Operations & Service Teams

AI agents can handle simple questions, freeing up service teams to focus on more complicated problems that need a human touch.

Teams for Compliance and Risk

AI can keep an eye on transactions all the time to make sure they are following the rules, look for risks, and let people know when they need to.

Credit & Lending Teams

AI quickly looks at loan applications and risks, which speeds up the process of getting a loan while making sure the rules are followed.

Customer Experience Teams

AI agents improve the customer journey by being available 24/7 to help whenever it’s needed.

Treasury & Investment Departments

AI gives us useful information about market trends and liquidity, which helps us make smart decisions.

Business Benefits for Banks & Financial Institutions

1. Reduced Operational Costs

Banks can save money on overhead costs by automating routine tasks. This frees up money that can be used to improve services for customers.

2. Faster Approval Times

AI agents can process applications more quickly, which means that loans, mortgages, and other banking services can be approved more quickly.

3. Improved Customer Experience

AI improves customer satisfaction and loyalty by providing support around the clock and personalized interactions.

4. Lower Manual Errors

AI reduces the chance of human error, making sure that financial transactions and reports are more accurate.

5. Stronger Fraud Prevention

AI helps stop fraud before it affects customers by keeping a close eye on things in real time.

6. Better Compliance & Reporting

AI makes it easier to follow the rules by automating reporting and data tracking.

7. Scalability Across Business Units

AI solutions can be easily expanded to work in different parts of a bank, which helps keep service delivery consistent.

Challenges to Consider Before Implementation

Data Readiness

To train AI systems well, banks and other financial institutions need good data. Bad data quality can really hurt performance.

Integration with Legacy Systems

A lot of banks still use old technology. It can be hard to make sure that AI systems work well with existing setups, and it may take careful planning.

Multilingual Understanding

AI agents in the Middle East need to be able to understand and speak a variety of languages to meet the needs of different customers.

Islamic Finance Compliance

AI must be built in a way that follows Islamic finance rules, which means it needs to have certain knowledge that might not be easy to find.

Data Privacy & Local Regulations

Banks have to follow strict rules about data to protect customer information. They have to make sure that their AI systems follow these rules.

Trust, Transparency, and Human Oversight

It’s very important to get customers to trust AI systems. Adding parts that are clear and overseen by people can help build trust and acceptance.

What Successful Middle East Banks Are Doing

Starting with Small Pilot Projects

Before rolling out AI to more customers, a lot of banks start with small pilot projects to see how well they work.

Combining Humans + AI

Successful banks combine human knowledge with AI capabilities to provide better service.

Focusing on Compliance & Security

Leading banks put compliance and security first when using AI, which lowers risks.

Scaling to Multiple Functions

AI solutions are being used in more and more banking functions to make the whole system work better once they have been shown to work.

Building Long-Term AI Strategies

Banks that are doing well aren’t just using AI for a short time; they’re also putting money into long-term plans that help them keep getting better and more flexible.

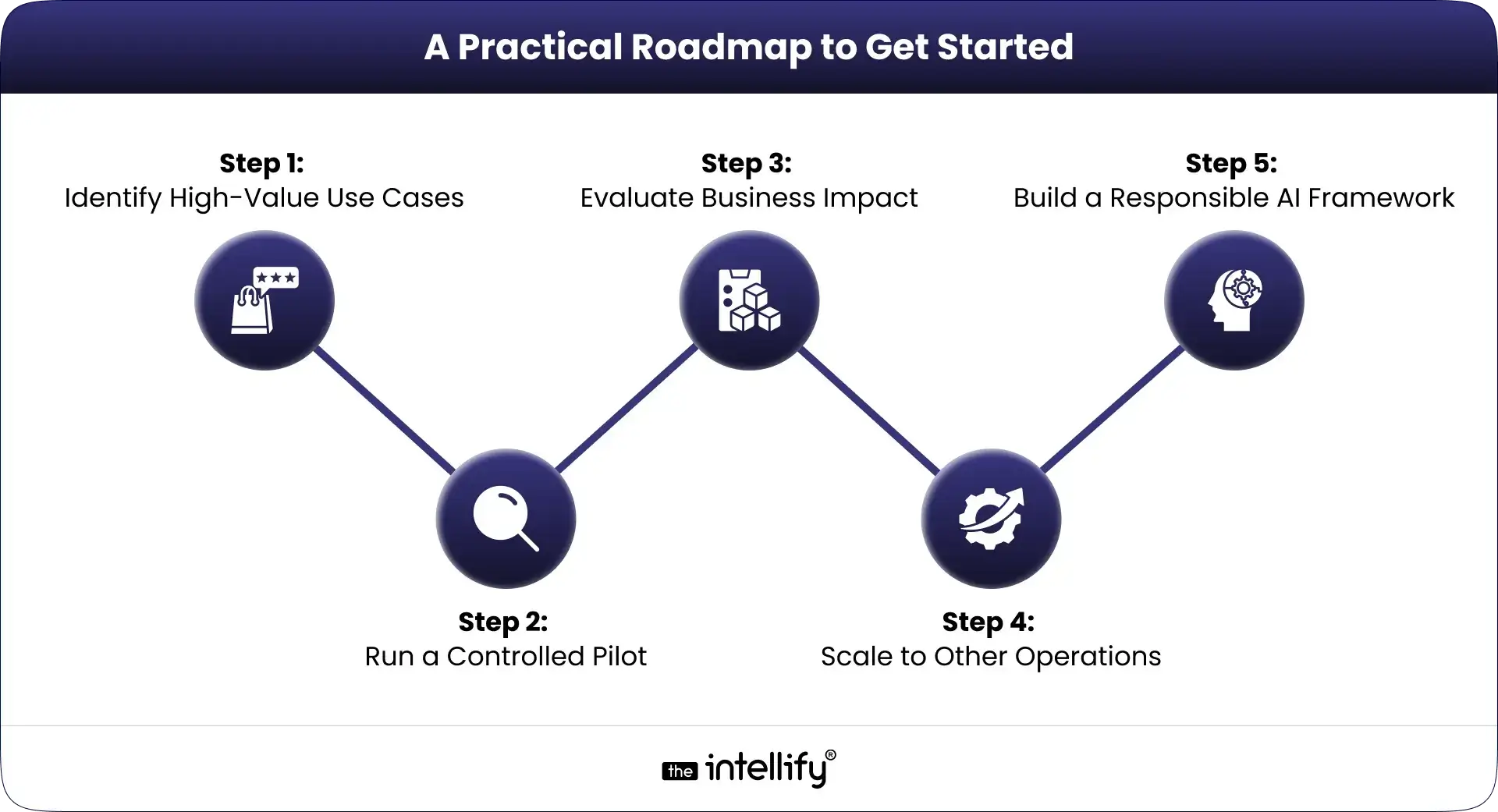

A Practical Roadmap to Get Started

Step 1: Identify High-Value Use Cases

Banks should start by figuring out which tasks would benefit the most from AI technology.

Step 2: Run a Controlled Pilot

Testing AI solutions in controlled environments helps us better understand how well they work.

Step 3: Evaluate Business Impact

It is very important to look at how using AI affects service quality, costs, and customer satisfaction.

Step 4: Scale to Other Operations

If a pilot is successful, slowly rolling out the solution to more departments can make them all work better.

Step 5: Build a Responsible AI Framework

It is important to make rules about ethics and make sure that everyone follows them in order to keep being successful.

Why Now Is the Best Time to Invest in AI

Regional AI Momentum

There is a lot of investment in AI in the Middle East right now, which is good for the growth of this field.

Competitive Pressure in Banking

Banks are under a lot of pressure to stay competitive, so they need to put money into AI solutions.

Digital-Native Customers

As more people become tech-savvy, digital solutions need to meet higher standards for convenience and personalization.

Faster Innovation Cycles

Banks can come up with new ideas more quickly and adapt to changing market conditions on the fly when they invest in AI.

Long-Term Efficiency Gains

Investing in AI will pay off in the long run by making operations more efficient and keeping customers happy for years to come.

Common Questions About Costs and ROI

How Much Money is required to invest?

Investments can be different depending on their size and purpose, but the costs at the beginning should be seen as necessary for long-term benefits.

How soon can we start seeing ROI?

Many companies say they see a return on investment (ROI) quickly, often within the first year, through cost savings and better efficiency.

Can AI agents work with the systems we already have?

Yes, many AI solutions are made to work well with current banking systems, but some upgrades may be necessary.

What skills do team members need?

To get the most out of AI solutions, you need a mix of IT skills, data analysis skills, and knowledge of the financial industry.

Conclusion

The rise of AI solutions in financial services is still in its early stages, but they are already making big changes in the Middle Eastern financial sector. AI agents aren’t just upgrades; they’re becoming essential because they can make experiences more personal, improve security, and speed up operations.

Now is the best time for banks and other financial institutions to put money into AI. By doing this, they will not only be able to keep up with changing market needs, but they will also be ready for future success.

Frequently Asked Questions (FAQs)

1. What are AI agents in finance?

AI agents are intelligent software designed to assist with banking operations and customer interactions by learning and adapting to user needs.

2. How can AI agents improve the banking experience in the Middle East?

They provide multilingual support, streamline processes, and make personalized recommendations, accommodating a diverse customer base.

3. Are AI agents beneficial for compliance in banking?

Yes, AI can automate compliance monitoring and reporting, helping reduce operational risks and improve accountability.

4. What challenges do bank face when implementing AI?

Challenges include data readiness, integration with older systems, and compliance with local regulations.

5. How quickly can banks see ROI from AI investments?

Many banks found that ROI can emerge within the first year through reduced costs and improved operational efficiency.

6. What steps should be taken to implement AI in banking?

Initiating pilot projects, evaluating impacts, and scaling successful solutions while maintaining compliance and ethical considerations are all essential steps.

Written By, Shravan Rajpurohit

Shravan Rajpurohit is the Co-Founder & CEO of The Intellify, a leading Custom Software Development company that empowers startups, product development teams, and Fortune 500 companies. With over 10 years of experience in marketing, sales, and customer success, Shravan has been driving digital innovation since 2018, leading a team of 50+ creative professionals. His mission is to bridge the gap between business ideas and reality through advanced tech solutions, aiming to make The Intellify a global leader. He focuses on delivering excellence, solving real-world problems, and pushing the limits of digital transformation.

AI for Healthcare Operations: Transforming Hospital Process in 2026

Summary: Healthcare is facing growing operational pressure due to rising patient demand, staffing limitations, and complex compliance requirements. This blog explores how AI for healthcare operations helps address these challenges by improving scheduling, billing, diagnostics, and documentation workflows. It highlights key business benefits, practical implementation steps, and strategic priorities for long-term success, offering hospital leaders […]

Emerging Digital Transformation Trends in AI, Cloud, & Intelligent Automation

Summary: Digital transformation trends focus on how businesses use AI, intelligent automation, hybrid cloud, data analytics, and cybersecurity to improve efficiency and customer experience. These trends help organizations modernize systems, make better decisions, reduce operational costs, and stay competitive. The blog explains real industry use cases, key challenges, and future developments, offering practical guidance for […]

AI Workflow Automation in Hospitals: Smarter Systems for Better Care

Summary: AI workflow automation is transforming hospital operations by streamlining both administrative and clinical tasks. This blog covers how AI for workflow automation connects systems like EHR, billing, lab, and scheduling platforms to reduce manual coordination, improve accuracy, and accelerate patient flow. It also highlights practical use cases, key benefits, implementation challenges, and best practices […]

AI for Healthcare Operations: Transforming Hospital Process in 2026

Summary: Healthcare is facing growing operational pressure due to rising patient demand, staffing limitations, and complex compliance requirements. This blog explores how AI for healthcare operations helps address these challenges by improving scheduling, billing, diagnostics, and documentation workflows. It highlights key business benefits, practical implementation steps, and strategic priorities for long-term success, offering hospital leaders […]

Emerging Digital Transformation Trends in AI, Cloud, & Intelligent Automation

Summary: Digital transformation trends focus on how businesses use AI, intelligent automation, hybrid cloud, data analytics, and cybersecurity to improve efficiency and customer experience. These trends help organizations modernize systems, make better decisions, reduce operational costs, and stay competitive. The blog explains real industry use cases, key challenges, and future developments, offering practical guidance for […]

AI Workflow Automation in Hospitals: Smarter Systems for Better Care

Summary: AI workflow automation is transforming hospital operations by streamlining both administrative and clinical tasks. This blog covers how AI for workflow automation connects systems like EHR, billing, lab, and scheduling platforms to reduce manual coordination, improve accuracy, and accelerate patient flow. It also highlights practical use cases, key benefits, implementation challenges, and best practices […]

0

+0

+0

+0

+Committed Delivery Leads To Client Satisfaction

Client Testimonials that keep our expert's spirits highly motivated to deliver extraordinary solutions.