Summary

This blog explains how to create a Digital wallet app from concept to launch. It covers market trends, wallet types, benefits, revenue models, and key development steps, including design, security, and cost factors. You’ll also discover popular examples and challenges in wallet app creation, plus how The Intellify helps businesses build secure, user-friendly, and scalable digital payment solutions.

The Rise of Digital Wallet Apps

The world is going cashless and faster than ever. With contactless payments becoming the new normal, digital wallet apps have transformed how people manage money, shop, and send payments. From small retailers to enterprise banks, businesses are adopting wallet apps to deliver convenience, speed, and security.

According to Statista, the global digital payments market is projected to reach $14 trillion by 2027, driven by mobile wallets and instant payment innovations. This surge presents a massive opportunity for businesses aiming to create a secure and user-friendly digital wallet app to serve modern consumers.

Let’s explore how you can build a feature-rich digital wallet app step by step and what it takes to turn this innovation into a profitable business asset.

Digital Wallet App Industry Overview

The digital wallet app industry has evolved from being a convenient payment option to a core part of financial ecosystems. With technologies like AI, blockchain, and biometric security, wallet apps now support multiple currencies, investment features, and global transactions.

- Global penetration: Nearly 60% of smartphone users use at least one digital wallet.

- Leading regions: North America, Europe, and Asia-Pacific dominate the wallet adoption rate.

- User demand: Speed, security, and seamless experience are the top expectations from wallet users.

The market is highly competitive yet full of opportunities, especially for businesses that combine innovation, compliance, and user trust.

What is a Digital Wallet?

A digital wallet (or e-wallet) is a mobile application that securely stores payment information such as credit cards, debit cards, loyalty points, and digital currencies. It enables users to make online or in-store transactions without needing physical cash or cards.

Simply put, it’s your financial identity stored digitally and protected with encryption and biometric authentication.

Popular examples include:

- Apple Pay – Seamless contactless payments for iOS users.

- Google Pay – Widely accepted and integrated with Android and web services.

- PayPal – The go-to global wallet for peer-to-peer and business payments.

A digital wallet simplifies financial management, making payments fast, secure, and borderless.

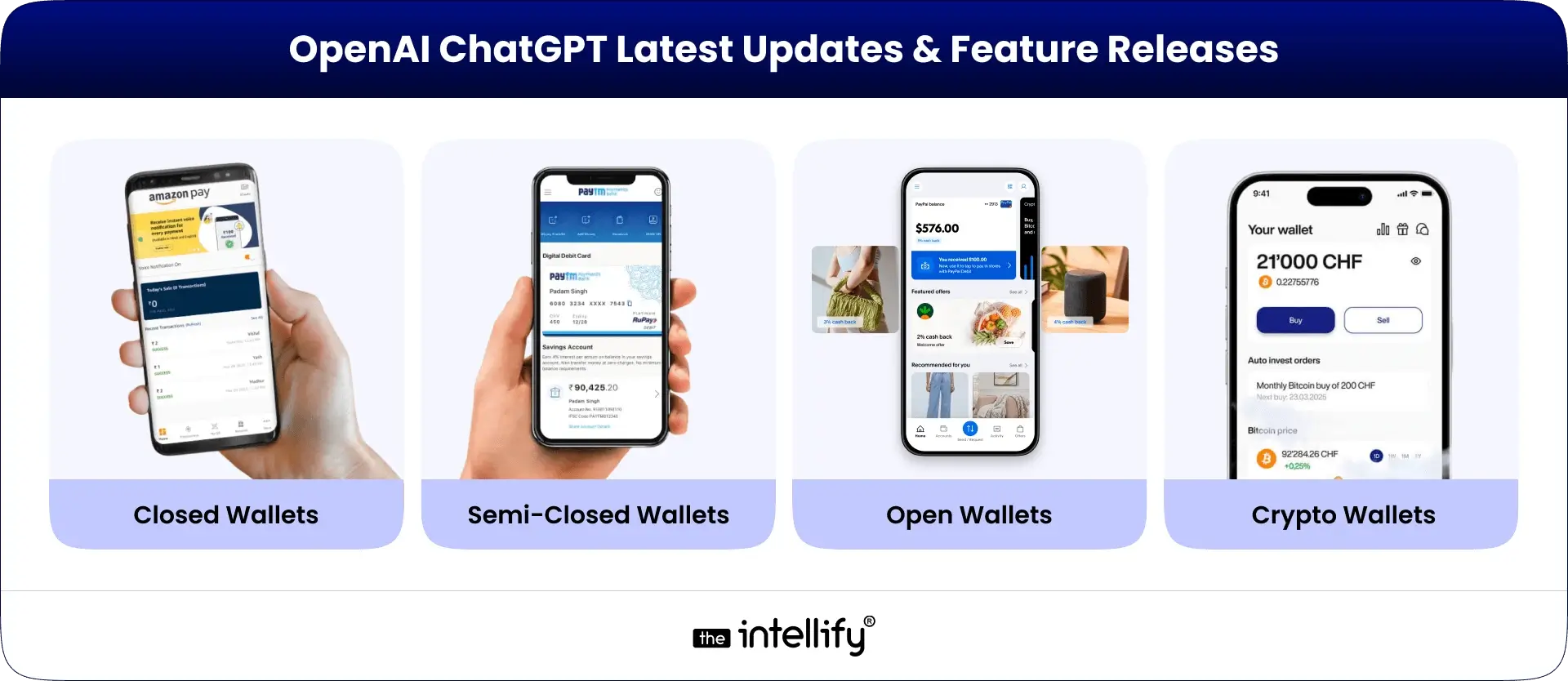

Different Types of Digital Wallet Apps

Before developing your wallet, it’s essential to decide what type fits your business model:

1. Closed Wallets

- Used only within a specific platform or brand.

- Example: Amazon Pay can only be used for purchases within Amazon.

- Ideal for businesses wanting to retain customer loyalty within their ecosystem.

2. Semi-Closed Wallets

- Can be used across multiple merchants who have a partnership with the wallet provider.

- Example: Paytm (India).

- Perfect for startups entering the fintech space with moderate regulation requirements.

3. Open Wallets

- Supported by banks or financial institutions.

- Allow full-scale transactions including withdrawals, transfers, and online purchases.

- Example: PayPal or Google Pay.

- Best suited for enterprises or regulated financial businesses.

4. Crypto Wallets

- Designed to store and transfer cryptocurrencies like Bitcoin or Ethereum.

- They use blockchain for secure, decentralized transactions.

- Choosing the right type depends on your business goals, target audience, and compliance requirements.

Benefits of Creating a Digital Wallet App

Creating a digital wallet app offers both short-term growth and long-term scalability for businesses. Here’s how:

- Seamless User Experience: Quick transactions and one-tap checkouts enhance customer satisfaction.

- Higher Customer Retention: Wallet-based loyalty points or rewards encourage repeat usage.

- Enhanced Security: With biometrics, tokenization, and two-factor authentication, wallets ensure safe payments.

- Brand Differentiation: Offering a custom wallet strengthens your brand’s tech-savvy image.

- New Revenue Streams: Monetize through transaction fees, commissions, and partnerships.

In 2025 and beyond, digital wallet apps are not just payment tools, they are a customer engagement ecosystem.

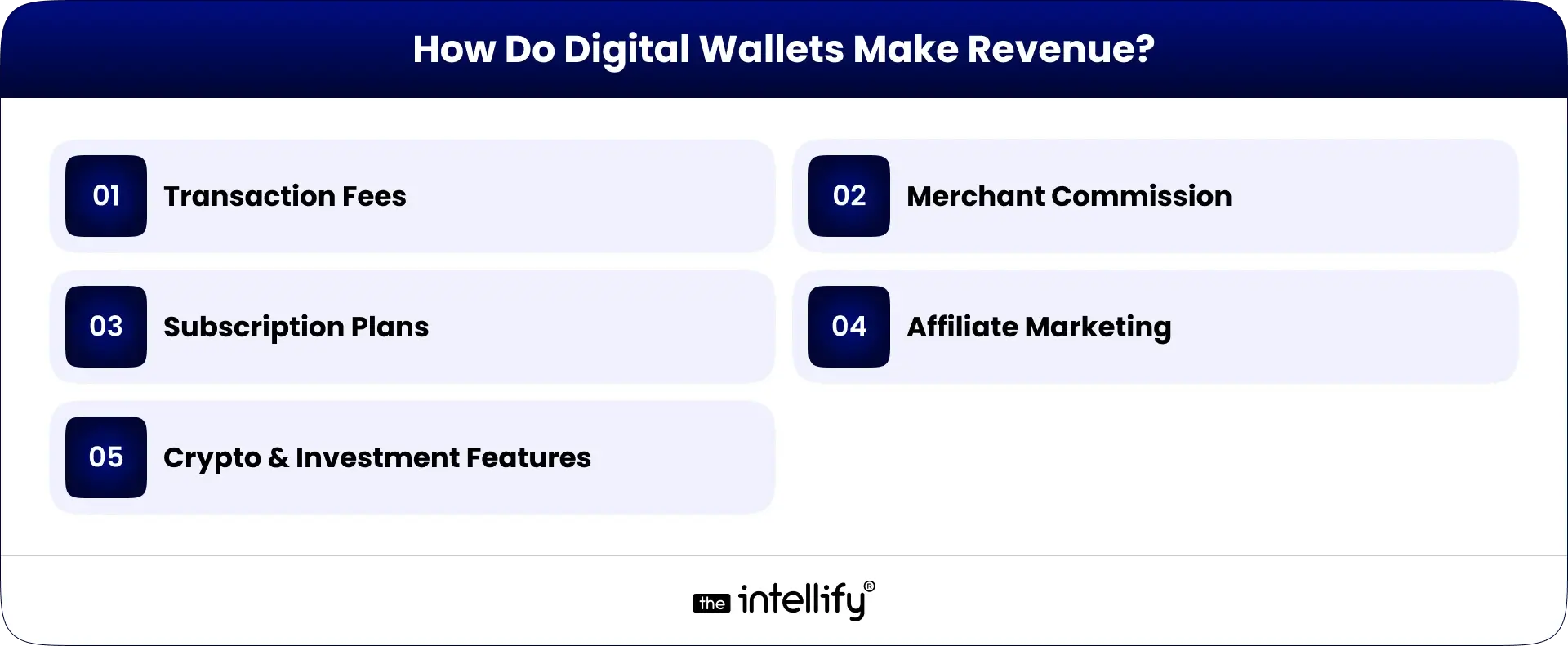

How Do Digital Wallets Make Revenue?

Wondering how you can profit from your wallet app? Here are the top monetization strategies:

1. Transaction Fees: Earn a small percentage on every payment or transfer made through the app.

2. Merchant Commission: Partner with vendors and charge commissions on in-app purchases.

3. Subscription Plans: Offer premium features like advanced analytics or faster transfers for paid users.

4. Affiliate Marketing: Display offers, ads, or partner deals to generate extra income.

5. Crypto & Investment Features: Integrate digital asset trading for high-value transactions.

Each model can be combined strategically to create a sustainable and scalable revenue plan.

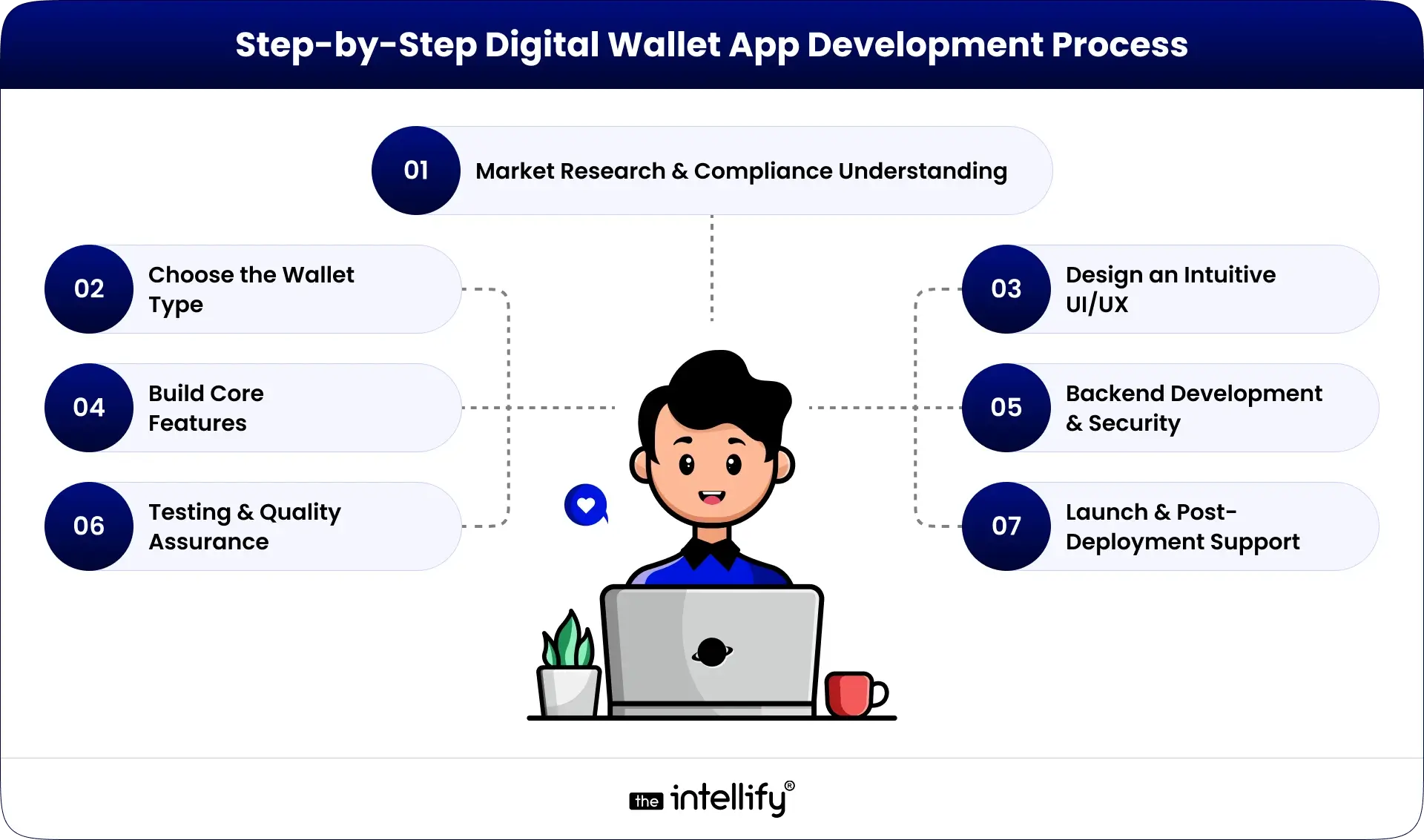

Step-by-Step Digital Wallet App Development Process

Let’s break down the development process into actionable stages:

Step 1: Market Research & Compliance Understanding

- Identify your target audience and region-specific payment habits.

- Understand legal and compliance requirements like KYC, GDPR, PCI DSS, and AML standards.

Step 2: Choose the Wallet Type

- Decide whether you need a closed, semi-closed, open, or crypto wallet.

- Align this with your business use case and desired functionalities.

Step 3: Design an Intuitive UI/UX

- The interface should be clean, easy to navigate, and optimized for speed.

- Focus on smooth onboarding, simple fund transfer flow, and minimal steps to complete a transaction.

Step 4: Build Core Features

Include essential modules like:

- User registration & KYC verification

- Bank account/card linking

- Fund transfer & request money

- QR code payments

- Transaction history

- Push notifications & loyalty points

Step 5: Backend Development & Security

- Implement strong data encryption, tokenization, and biometric authentication.

- Integrate reliable APIs for payment gateways, analytics, and fraud detection.

Step 6: Testing & Quality Assurance

- Conduct performance, usability, and security testing.

- Simulate real-world payment conditions to ensure reliability under high traffic.

Step 7: Launch & Post-Deployment Support

- Release your app on app stores and gather feedback.

- Continuously update with new features, bug fixes, and compliance updates.

Pro Tip: Partnering with an experienced Digital wallet app development company like The Intellify can save months of trial and error while ensuring your app meets compliance and security standards from day one.

How Much Does It Cost to Develop a Digital Wallet App?

The cost to develop a digital wallet app varies based on complexity, platform, and required features.

Here’s a general estimate:

- Basic wallet app: $40,000 – $60,000

- Advanced wallet app with integrations: $70,000 – $120,000

- Enterprise-grade wallet or crypto app: $120,000 – $150,000+

Key cost factors:

- App design & UX complexity

- Platform (Android, iOS, or cross-platform)

- Feature list (KYC, AI insights, multi-currency support, etc.)

- Developer location (costs are higher in the US, lower in India)

Working with a specialized fintech app partner like The Intellify ensures cost efficiency, faster turnaround, and superior app quality.

Popular Examples of Digital Wallet Apps

Learning from the leaders can inspire your app’s roadmap.

1. PayPal: The pioneer in digital transactions, trusted for global money transfers.

2. Google Pay: Known for its intuitive UI and loyalty integrations.

3. Apple Pay: A benchmark in security and user privacy.

4. Venmo: Popular among millennials for peer-to-peer payments and social integration.

5. Paytm: An all-in-one wallet integrating payments, shopping, and banking.

Each of these apps succeeded by offering security, convenience, and user trust, the three pillars your app must build upon.

Start Your Digital Wallet App Development Journey with The Intellify

Building a digital wallet requires more than just technical expertise, it demands a deep understanding of fintech regulations, security frameworks, and user behavior.

At The Intellify, we help startups, enterprises, and financial institutions design, develop, and scale custom digital wallet solutions with cutting-edge technologies and an unmatched user experience.

Whether you want to build a mobile wallet app, a crypto payment solution, or a multi-currency wallet, our team ensures:

- Bank-grade security & compliance

- Frictionless payment experience

- Custom feature integration

- 24/7 post-launch support

*Let’s build your digital wallet app that transforms how users pay, save, and engage.

Final Thought

Digital wallets are no longer a luxury, they’re the future of financial interactions. As more consumers move toward cashless payments, businesses that invest in digital wallet app development today will lead the fintech race tomorrow.

If you’re ready to create a secure, scalable, and user-loved wallet app, The Intellify is your trusted partner to turn that idea into reality.

Frequently Asked Questions (FAQs)

1. What is a digital wallet app, and how does it work?

A digital wallet app is a mobile platform that lets users store their financial information like credit cards, bank accounts, or digital currencies, safely on a device. It allows users to pay, transfer funds, and manage transactions digitally, eliminating the need for cash. The Intellify builds secure digital wallet apps that ensure smooth, fast, and safe payments for both businesses and users.

2. Why should my business consider developing a digital wallet app?

Creating a digital wallet app helps businesses offer convenience, faster checkouts, and loyalty features to customers. It also opens new revenue streams through transaction fees and partnerships. With expertise in digital wallet app development, The Intellify guides businesses to build apps that increase customer retention and brand trust.

3. How do digital wallet apps generate revenue?

Digital wallet apps earn revenue through multiple channels:

- Transaction fees on user payments

- Commissions from merchants

- Subscription plans for premium features

- Affiliate offers and promotions

Partnering with The Intellify ensures your digital wallet is designed to capture these revenue opportunities while remaining user-friendly and secure.

4. What are the key features to include in a digital wallet app?

Essential features of a digital wallet app include:

- Secure user authentication (biometrics, two-factor authentication)

- Support for multiple payment methods

- Transaction history and notifications

- Loyalty and reward programs

- Robust encryption and fraud detection

The Intellify specializes in integrating these features to deliver apps that are both secure and engaging for users.

5. How much does it cost to develop a digital wallet app?

The cost varies based on the app’s complexity, platform, and features. A typical digital wallet app can cost between $40,000 and $150,000, depending on custom requirements. The Intellify helps businesses optimize costs by providing tailored solutions without compromising on security or quality.

6. What are the challenges in developing a digital wallet app?

Developing a digital wallet app comes with challenges such as:

- Ensuring strong security and fraud prevention

- Meeting regulatory compliance (KYC, GDPR, PCI DSS)

- Achieving smooth integration with banks and payment gateways

- Building user trust and adoption

With experience in fintech solutions, The Intellify helps overcome these hurdles, delivering compliant and secure wallet apps.

7. How can The Intellify assist in developing my digital wallet app?

The Intellify offers end-to-end services for creating digital wallet apps, from strategy and design to development and post-launch support. We ensure apps are secure, scalable, and user-friendly, helping businesses stay ahead in the competitive digital payments market.

Written By, Darshak Doshi

With over a decade of experience, Darshak is a technopreneur specializing in cloud-based applications and product development in healthcare, insurance, and manufacturing. He excels in AWS Cloud, backend development, and immersive technologies like AR/VR to drive innovation and efficiency. Darshak has also explored AI/ML in insurance and healthcare, pushing the boundaries of technology to solve complex problems. His user-focused, results-driven approach ensures he builds scalable cloud solutions, cutting-edge AR/VR experiences, and AI-driven insights that meet today’s demands while anticipating future needs.

Augmented Reality Storytelling: Turning Brand Stories into Immersive Experiences

Summary: This blog explores how Augmented Reality Storytelling helps brands create deeper engagement through immersive, interactive experiences. It explains what AR storytelling is, how it works, real-world brand examples, key benefits, and common use cases across industries. The article also covers essential features of an AR storytelling app, how to choose the right AR app […]

Fuel Delivery App Development: A Complete USA Guide

Summary: This blog covers everything you need to know about fuel delivery app development, including how on-demand fuel delivery works, key features, costs, and legal considerations in the USA. It explains how businesses can build, launch, and scale a fuel delivery app while ensuring safety, compliance, and smooth operations. Whether you’re planning a new fuel […]

How AI Agents in Finance Are Transforming the Middle East

Summary: This Blog will explain what AI agents in finance are, their utility in the Middle Eastern market, their applications in the real world, the benefits they can bring to businesses, and how financial institutions can effectively utilize these tools. The Middle East’s finance industry is changing quickly, mostly because of new technologies and […]

Transforming Legacy Application Modernization with AI and Automation

Summary: Legacy Application Modernization helps businesses upgrade outdated systems while maintaining operational stability. Many enterprises face technical debt, scalability challenges, and security risks that limit growth. By combining AI-driven automation with structured modernization strategies, organizations can improve performance, strengthen compliance, and enhance user experience. The blog also covers legacy mobile app modernization, industry use cases, […]

Enterprise AI Strategy & Adoption: Step-by-Step Implementation Guide

Summary: In today’s fast-paced business environment, enterprise AI is no longer just a buzzword; it’s become essential. Its potential to reshape operations, enhance decision-making, and drive efficiency is making AI a crucial part of organizational strategies around the globe. In this guide, we’ll explore how businesses can methodically adopt AI, from crafting a solid strategy […]

AI in Healthcare Claims Processing: A Practical Implementation & ROI Guide

Summary: Healthcare claims processing is often slow, manual, and prone to costly errors. This blog breaks down how AI in healthcare helps reduce denials, speed up reimbursements, and improve revenue cycle performance. You’ll see how AI supports each step of the claims process, what benefits providers and insurers can expect, and what it takes to […]

0

+0

+0

+0

+Committed Delivery Leads To Client Satisfaction

Client Testimonials that keep our expert's spirits highly motivated to deliver extraordinary solutions.